“`html

Effective Ways to Void a Check in 2025: Understand the Process and Avoid Mistakes

In today’s financial world, understanding how to void a check is crucial for preventing errors and avoiding potential fraud. This article will provide a comprehensive look at what it means to void a check, when you should do it, and the effective steps involved in the check cancellation process for 2025. With these insights, you can ensure that your financial transactions are secure and correctly managed.

Understanding the Check Cancellation Process

Voiding a check involves officially invalidating it to prevent it from being cashed or deposited. It’s essential to understand the check cancellation process to protect yourself from fraud or errors. When you void a check, you must mark it clearly with the word ‘VOID’ written across it. This action communicates to banks and cashiers that the check is no longer valid, ensuring that all parties are aware.

What Does It Mean to Void a Check?

Voiding a check typically entails rendering it useless for cashing or deposit. This can happen for several reasons, such as incorrect amounts, miswritten payee names, or simply realizing that you no longer need the transaction. Understanding how to properly communicate your desire to void a check is part of ensuring that the voiding process is done effectively. It is crucial to follow proper check management tips to navigate this process smoothly.

Cancellation of Checks: When Is It Necessary?

There are various instances where you may need to cancel a check. One common situation occurs when a mistake is made in writing the check, such as entering the wrong amount or date. Additionally, if the recipient of the check no longer requires payment, it is prudent to void the transaction to avoid complications. Being diligent about when to void a check can save you from possible financial transaction disputes.

Understanding Bank Procedures for Voiding Checks

When you approach your bank to void a check, it’s important to follow their specific procedures. Generally, you’ll need to fill out a check stop payment form, which instructs the bank to prevent the check from being cashed. Understanding the nuances of check fraud prevention and bank policies will further empower you to manage your checks effectively.

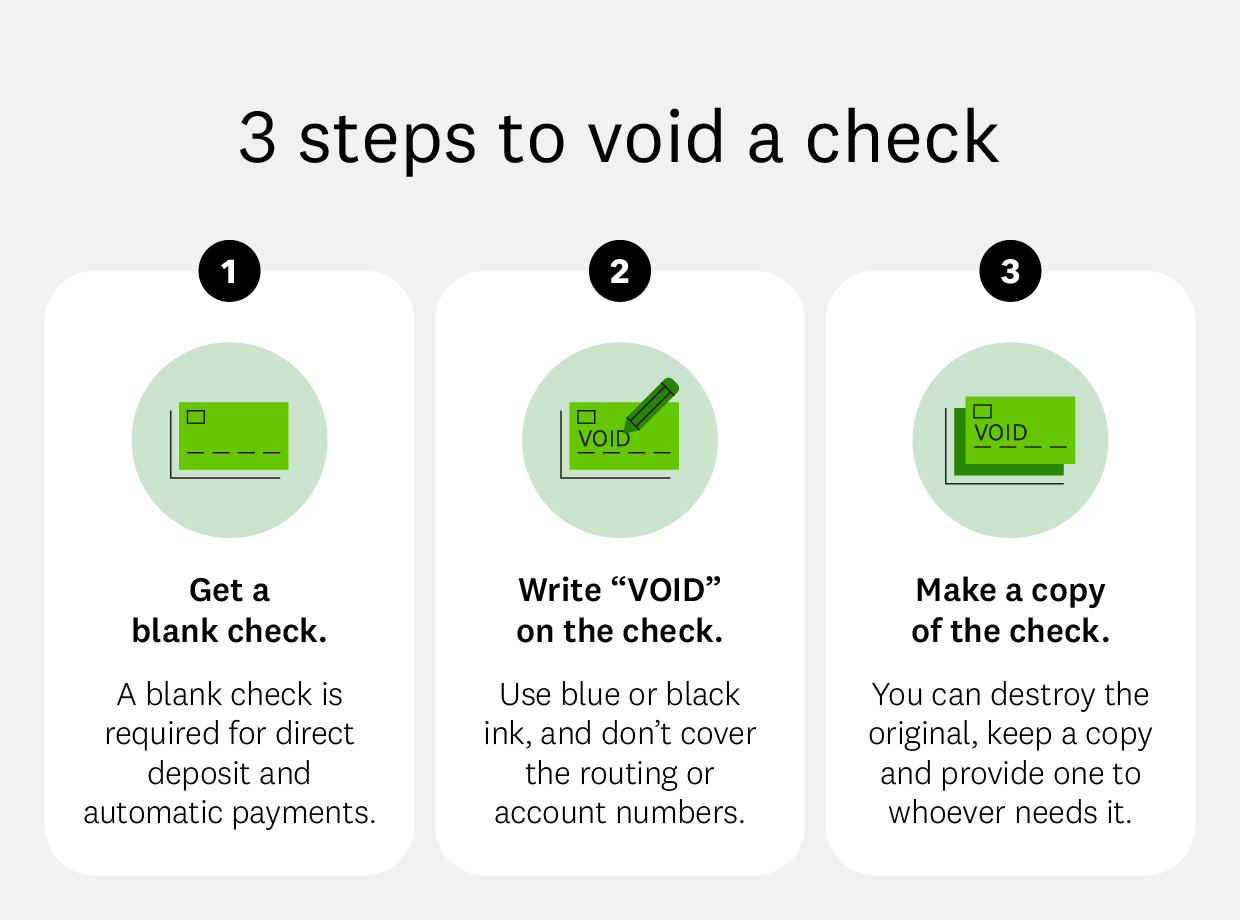

How to Void a Check: Step-by-Step Guide

Knowing the correct procedure for voiding checks is imperative for effective financial management. Here’s a detailed voicing check procedure you can easily follow:

Step 1: Mark the Check as Void

The first step in the voiding checks online process is marking the check directly. Write ‘VOID’ in large letters across the front of the check. Be sure to include both the date and any other relevant information to clarify which check is being voided. This action immediately indicates to anyone who might view the check that it is cancelled.

Step 2: Notify Your Bank

Next, it’s crucial to notify your bank to void check officially. You may need to either visit a bank branch, use online banking services, or call customer service, depending on your bank’s procedures. Having the check number handy will simplify the process and make your communication much clearer.

Step 3: Keep Records of the Voided Check

It’s prudent to maintain a record of the voided check. This means filing the voided check away neatly with your other financial documents. Keeping a good financial record can help you in case of future inquiries about transactions related to that check, creating a robust checking account security protocol.

Managing Check Payments to Avoid Errors

Properly managing your check payments is essential to preventing mistakes that require voiding. Here are some valuable financial management tips to keep in mind:

Following Check Writing Guidelines

Adhering to basic check writing guidelines can reduce the likelihood of needing to void a check. Always double-check the payee name, amount, and date before finalizing your check. Clear and legible handwriting is crucial, as illegible entries can lead to potential disputes.

Utilize Digital Payments When Possible

In many cases, using digital payment methods can minimize complications related to checks. Online banking and payment services often offer enhanced report lost check features, reducing risks associated with physical checks. If you’re concerned about security or ease of use, consider transitioning many transactions to these digital platforms.

Establishing a Check Cancellation Policy

Creating a personal or business check cancellation policy is a proactive step. A clear outline of procedures to follow when payments need to be cancelled or voided can streamline the process significantly. This helps maintain clarity and assists everyone involved in financial transactions.

Key Takeaways

- Always void checks clearly: Marking ‘VOID’ is essential.

- Inform your bank promptly: Notify them to ensure checks can’t be cashed.

- Maintain organized records: Keep copies of voided checks for future reference.

FAQ

1. How long does it take for a check to be voided?

The time it takes to void a check can vary based on your bank’s procedures. In most cases, if you properly notify the bank and follow their processes, the voiding is usually effective immediately.

2. Can I void a check online?

Yes! Many banks allow you to void a check through online platforms. Ensure you log into your account, navigate to the appropriate section, and proceed accordingly to ensure the check is voided.

3. What if I’ve reported a check lost before?

If you’ve already reported your check lost, but it turns out you didn’t need to, you can still void it by informing your bank of the change. This will ensure any confusion regarding the check’s status is rectified.

4. Is there a fee to void a check?

Some banks may charge a fee to void a check, particularly if it involves a stop payment request. Always check with your bank regarding their specific policies on check voiding and associated fees.

5. What are the consequences of not voiding a check?

If a check is not voided properly and is cashed accidentally, it can lead to significant complications, including potential overdraft fees or disputes. Always ensure checks you intend to cancel are properly voided to avoid such issues.

6. How can I prevent check fraud?

To protect against check fraud, always monitor your bank statements, and ensure your checks are correctly written, securely stored, and promptly canceled if unnecessary. Additionally, keeping your banking information confidential is fundamental to your security.

“`