How to Properly Write a Check: Essential Steps for 2025

Understanding the Basics of Writing a Check

Learning how to properly write a check is an essential skill that everyone should master. In today’s digital age, checks may seem less common, but they still serve vital functions in transactions. Knowing how to fill out a check correctly avoids confusion and ensures that payments are processed smoothly. This guide will walk you through each step, from choosing the right check to signing it properly, making your payment process easier.

Necessary Materials for Writing a Check

Before diving into the actual writing process, gather your materials. You’ll need a checkbook, a pen, and the necessary recipient information. Using a pen is crucial since it prevents alterations to your check. Typically, black or blue ink is standard, keeping your checks professional and legible. The checkbook itself often contains stubs that you can use to record your transaction details, which helps you maintain accurate financial records. Keeping such records is essential for tracking expenses and balancing your checkbook.

Filling Out the Check Correctly

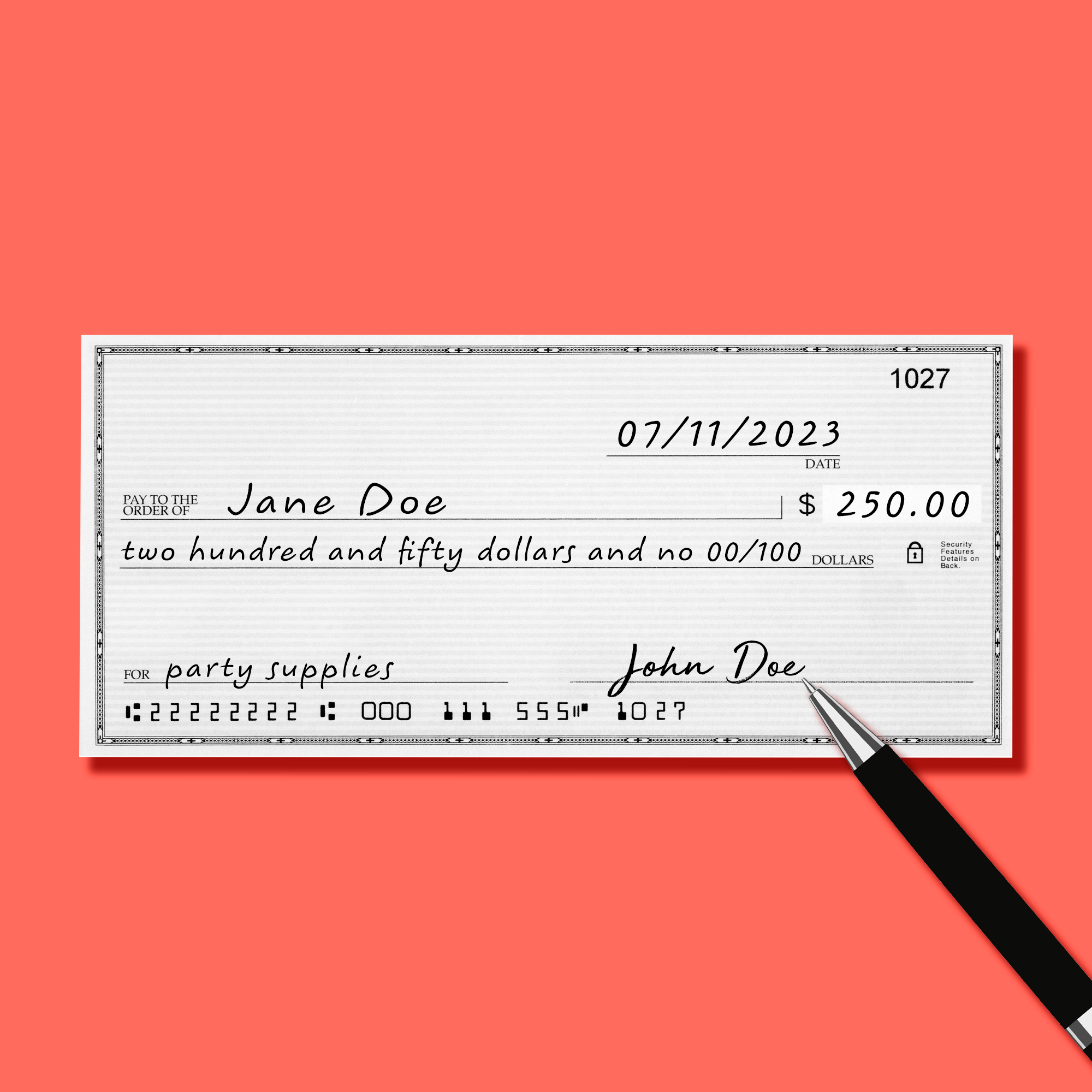

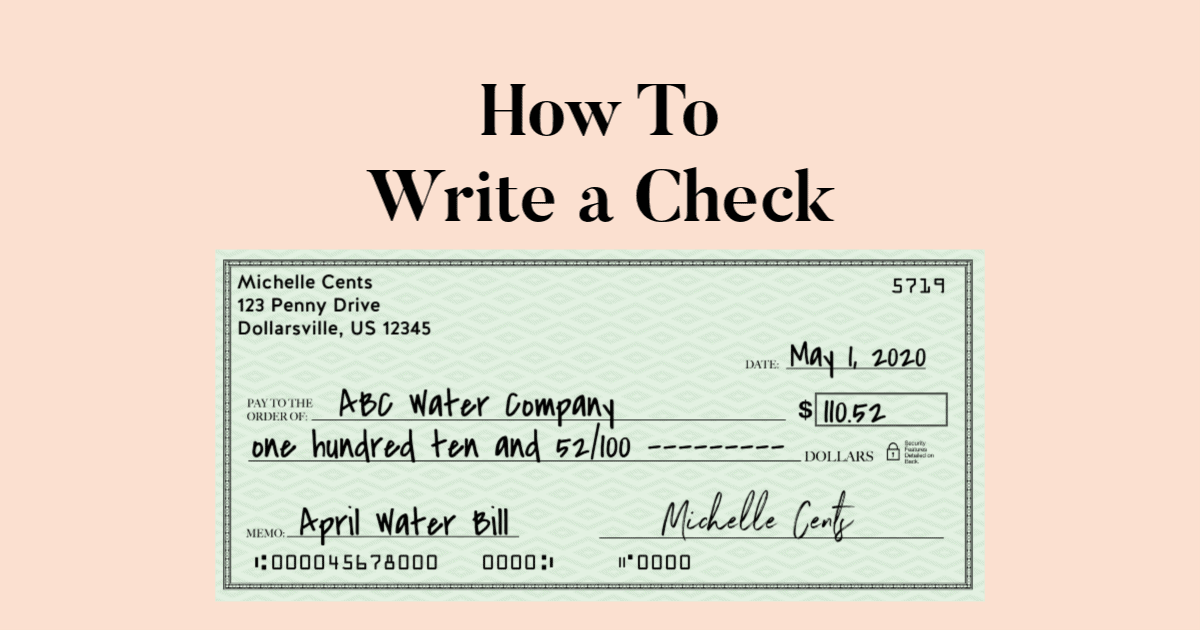

To fill out a check correctly, follow these steps: First, date the check on the line provided, usually located at the top right. This information is crucial for both you and the recipient. Next, enter the name of the person or organization you are paying on the line that begins with “Pay to the Order of.” Ensure that the name is spelled correctly. Then, write the amount being paid in both numeric and written formats. For instance, if you’re paying $100.00, you’d write “One hundred and 00/100.” This double notation minimizes errors and fraudulent changes. Finally, sign the check on the bottom right, as your signature authorizes the payment. It’s important to remember that if the signature doesn’t match the one the bank has on file, the check may bounce.

Common Mistakes When Writing a Check

Even though writing a check is straightforward, many people make common mistakes. Recognizing them can help streamline your checking process. Miswriting the amount is one of the most common errors, whether in numeric or written form. Additionally, forgetting to sign the check or placing the signature in the wrong spot can lead to payment delays. Be aware of this and double-check each field when you write a check. Moreover, it’s important that the date is correct; writing an old date or leaving it blank can lead to complications when cashing the check.

Example of a Properly Written Check

To illustrate how to write a check, consider the following example. Suppose you need to pay for a service that costs $150.00. Your check should include the date, the payee’s name, the amount in numbers ($150.00) and in words (“One hundred fifty and 00/100”), and your signature. This way, the recipient can easily understand the sum and it minimizes the risk of fraud. After writing the check, retain a copy or fill out the stub in your checkbook with details such as the date, amount, and purpose of the payment for your records.

How to Record Transactions in Your Check Register

Keeping track of your check transactions involves using a check register. This record is crucial for managing your finances effectively. Each entry should include the date you wrote the check, the recipient’s name, the amount paid, and a brief description of the transaction purpose. Regularly updating your check register lets you know your current balance, preventing overdrafts and ensuring you remain aware of your spending. Aim to reconcile your checkbook with your bank statement monthly to catch any discrepancies early.

Security Tips for Writing Checks

Even with the digital convenience that comes with online banking and payments, checks can remain secure if you follow certain practices. First, always write checks from a secure location. Avoid writing checks in public or where others can see your details. Secondly, print personal checks instead of using handwritten ones if possible; pre-printed checks often have added features, such as watermarks, which deter counterfeiters. Lastly, consider purchasing checks with security features, such as color-shifting ink and heat-sensitive ink, for additional protection.

What to Do in Case of a Lost or Stolen Check

If you lose a check or it is stolen, act quickly to protect your finances. Notify your bank immediately to report the loss; they can place a stop payment on the check. This prevents anyone from cashing it. Also, monitor your bank statements closely for unusual activity, ensuring you catch any unauthorized transactions as they occur. Keeping a record of checks written will help you see if any funds are missing and assist in disputing any potential fraud.

Potential Fees Associated with Checks

When writing checks, being aware of potential bank fees is prudent. Some banks charge for check processing, especially for checks that bounce due to insufficient funds. Additionally, overdraft protection can incur fees, so always ensure funds are available before issuing a check. Understanding these fees can better equip you to manage your banking and avoid unexpected charges that might affect your cash flow.

Conclusion

Mastering the art of writing a check is key to effective personal finance management. By following the essential steps detailed above, you ensure that payments are correctly processed and that you maintain financial security. Regular practice and attention to detail can enhance your confidence in managing payments through checks as we move into 2025 and beyond.

Key Takeaways

- Always use proper materials, such as a pen and checkbook, when writing checks.

- Include essential details such as the date, payee name, amount, and your signature.

- Be aware of common mistakes to avoid delays and complications.

- Maintain a check register to keep track of your transactions and balance.

- Implement security measures to protect against fraud.

FAQ

1. What do you do if a check bounces?

If a check bounces, the first step is to contact your bank to understand the reason. Depending on bank policies, you may incur a bounced check fee. Immediately inform the payee and arrange for alternative payment to maintain trust. Ask your bank if you can clear your balance to avoid this situation. Understanding your overdraft policy can help you avoid future mishaps and financial setbacks.

2. How long is a check valid?

Generally, checks are valid for six months from the date written. After this period, they become “stale” and banks may refuse to cash them. However, it’s advisable to check with your bank, as policies can differ. Keeping track of check dates can help manage your finances more efficiently and avoid complications.

3. Can I write a check to myself?

Yes, you can write a check to yourself, often referred to as a “self-check.” This practice can help transfer funds between your accounts. Simply fill in your name as the payee and cash it at your bank. It’s an efficient way of moving money, but always consider online transfers for more security and ease.

4. Are there limits on the amount of a check?

While there is no officially set limit for check amounts, practical restrictions apply based on account balances. If the check amount exceeds your current balance, it will bounce unless you have overdraft protection. It’s crucial to keep track of your check writing to maintain your account balance and avoid unwanted fees.

5. What information do I need to write on the check?

The essential information required when writing a check includes the date, payee’s name, amount in both numbers and words, and your signature. Including your address, and marking it as paid, are good practices but not mandatory. Always double-check that this information is correct to avoid delays in the processing of payments.