“`html

Essential Guide to Chapter 7 Bankruptcy: Discover Debt Limits for 2025

Understanding Chapter 7 Bankruptcy

Chapter 7 bankruptcy is a type of personal bankruptcy that allows individuals to eliminate most of their unsecured debts while providing them with a financial fresh start. This process can be incredibly helpful for those who qualify for Chapter 7, allowing them to wipe the slate clean. However, it’s important to know the **debt requirements Chapter 7** stipulates and key factors such as income limits, household size, and the **Chapter 7 means test.

Qualifying for Chapter 7

To qualify for Chapter 7 bankruptcy, individuals must meet specific eligibility criteria, primarily determined via the **Chapter 7 means test**. This test evaluates an individual’s income against the median income for their state. If their income is below the median, they may qualify easily. For 2025, understanding the **income limits for Chapter 7** becomes crucial, as they often change alongside inflation. Additionally, those with disposable income after deducting necessary living expenses may find themselves unqualified for **Chapter 7 dischargeable debts**.

Debt Requirements for Filing Chapter 7

The **debt requirements Chapter 7** specifies that individuals must have primarily unsecured debts to qualify. This includes credit card debts, medical bills, and personal loans—debts that do not require collateral. However, secured debts, such as mortgages and car loans, are treated differently and may not be discharged through Chapter 7. Understanding both **secured and unsecured debts** can help potential filers navigate their financial situation accurately.

Filing Chapter 7: The Process

The **Chapter 7 process** begins with the filing of a **Chapter 7 petition** with the bankruptcy court, accompanied by necessary documentation regarding income, debt, and assets. After this initial filing, a **Chapter 7 trustee** is designated to oversee the case, assessing the debtor’s assets and debts. A successful bankruptcy process culminates in a discharge order for eligible debts, offering individuals a much-needed financial reset.

Benefits and Drawbacks of Chapter 7 Bankruptcy

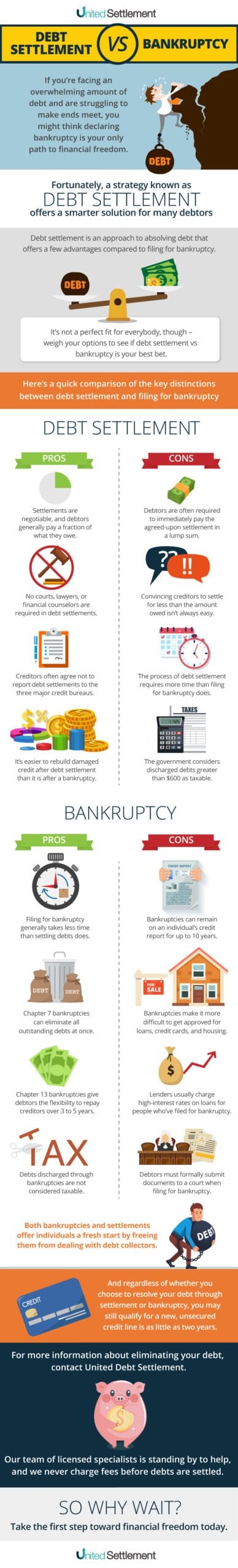

Understanding the implications of filing Chapter 7 can help individuals make informed decisions. While the benefits of a **financial fresh start** are appealing, potential drawbacks, such as impacts on credit score, must also be considered.

Benefits of Chapter 7 Bankruptcy

One of the biggest draws of Chapter 7 bankruptcy is the immediate relief it provides from creditors’ actions, including collection calls and lawsuits. Additionally, **debts forgiven Chapter 7** allow individuals to recover financially without the burden of certain outstanding obligations. This kind of restructuring enables those in dire straits to focus on rebuilding their financial foundations.

Drawbacks to Consider

While there are numerous benefits, the **credit score impact Chapter 7** can be significant. Individuals may see a substantial dip in their credit scores, which can remain on their credit reports for up to 10 years. Moreover, some assets may be lost during the bankruptcy process, which can complicate post-bankruptcy life. Understanding these **Chapter 7 drawbacks** is crucial when considering the potential long-term effects on one’s financial health.

Addressing Chapter 7 Myths

When it comes to **Chapter 7 myths**, many believe that all debts are easily discharged. However, not all debts are dischargeable; certain obligations such as tax debts, student loans, and child support obligations fall under the category of **Chapter 7 non-dischargeable debts**. Clearing the air on these misconceptions is vital for anyone contemplating bankruptcy as a solution.

After Filing Chapter 7: Key Considerations

After filing for Chapter 7 bankruptcy, certain actions can help individuals navigate post-bankruptcy life more smoothly. Planning and strategic thinking are important aspects to consider after the **Chapter 7 timeline**.

Steps Immediately After Filing

Post-filing, it is essential to establish a plan for managing finances now that most dischargeable debts are forgiven. This involves creating a strict budget, rebuilding credit, and setting up emergency funds. Taking proactive steps like **credit counseling** can provide valuable support during this transitional period. Additionally, keeping track of necessary **Chapter 7 paperwork** and maintaining open communication with the bankruptcy trustee is crucial.

Long-term Financial Recovery

Rebuilding credit after filing Chapter 7 isn’t as daunting as it seems. One effective method includes obtaining a secured credit card or using credit responsibly. Exploring debt relief options like debt consolidation or even budgeting techniques can ensure long-term stability. As individuals work on their **credit score recovery post-bankruptcy**, it’s critical to maintain consistency in financial practices to prevent falling back into debt.

Trustee Role in Chapter 7

The **Chapter 7 trustee** plays a significant role in managing the assets and ensuring the debtor complies with all established obligations during the bankruptcy process. Understanding the implications of having a trustee and what they assess can help debtors prepare adequately. Trustees are crucial figures in determining how assets may be liquidated to repay creditors, which highlights the importance of complete transparency during the process.

Frequently Asked Questions about Chapter 7 Bankruptcy

1. What debts can be discharged in Chapter 7?

In general, **discharge debts in Chapter 7** include unsecured debts like credit card balances, medical expenses, and personal loans. However, certain debts such as student loans, child support obligations, and certain tax debts are typically **non-dischargeable debts in Chapter 7**. Understanding these categories is crucial for anyone assessing their eligibility.

2. How does filing Chapter 7 affect my credit score?

Filing **Chapter 7 bankruptcy** can significantly impact your credit score, often resulting in a decline of around 200 points or more. This negative impact remains on a credit report for up to ten years. However, positive financial behaviors after filing, such as making timely payments, can help improve your score over time.

3. What are the income limits for Chapter 7 in 2025?

The **income limits for Chapter 7** bankruptcy depend on the state and household size. The median income thresholds are adjusted periodically, so it’s important to check your state’s guidelines for the most current figures before applying. Meeting these income requirements is essential for determining eligibility.

4. Can businesses file for Chapter 7 bankruptcy?

Yes, **Chapter 7 for businesses** is an option, allowing businesses to liquidate assets and discharge business-related debts. However, personal guarantees can affect the owner’s financial situation, so it’s much more complicated than individual filings and often requires specialized legal guidance.

5. How long does the Chapter 7 process take?

The typical **Chapter 7 timeline** spans about four to six months from the filing of the petition to the discharge of debts. During this period, creditors have the opportunity to claim their debts, and the trustee manages asset distributions, making the timeline essential to understand for proper financial planning.

6. Are there alternatives to Chapter 7 bankruptcy?

Absolutely, several **Chapter 7 alternatives** exist, including Chapter 13 bankruptcy, debt negotiations, and debt consolidation. It’s crucial to examine all available options before making a decision on the best route for your unique financial situation. Consulting with a financial advisor may also provide meaningful insights on the most suitable options.

Key Takeaways:

- Chapter 7 bankruptcy provides individuals with a fresh financial start by discharging most unsecured debts.

- Debtors must meet specific income and debt requirements to qualify for Chapter 7.

- While beneficial, Chapter 7 bankruptcy has a significant impact on credit scores and must be considered with caution.

- Understanding the role of the Chapter 7 trustee is crucial for avoiding potential pitfalls in the bankruptcy process.

- After filing for Chapter 7, rebuilding finances and establishing credit should be prioritized for long-term recovery.

As you contemplate the complexities of **filing Chapter 7**, always remember the importance of seeking professional legal assistance or consulting with a bankruptcy attorney to ensure the best outcomes for your financial future.

“`